Town of Scituate / Tax Collector's Office

Town of Scituate / Tax Collector's Office

PO Box 328, North Scituate, RI 02857

Public Notices

Ad textTown of Scituate / Tax Collector's Office TOWN OF SCITUATE

NOTICE OF PROPOSED PROPERTY TAX RATE CHANGE

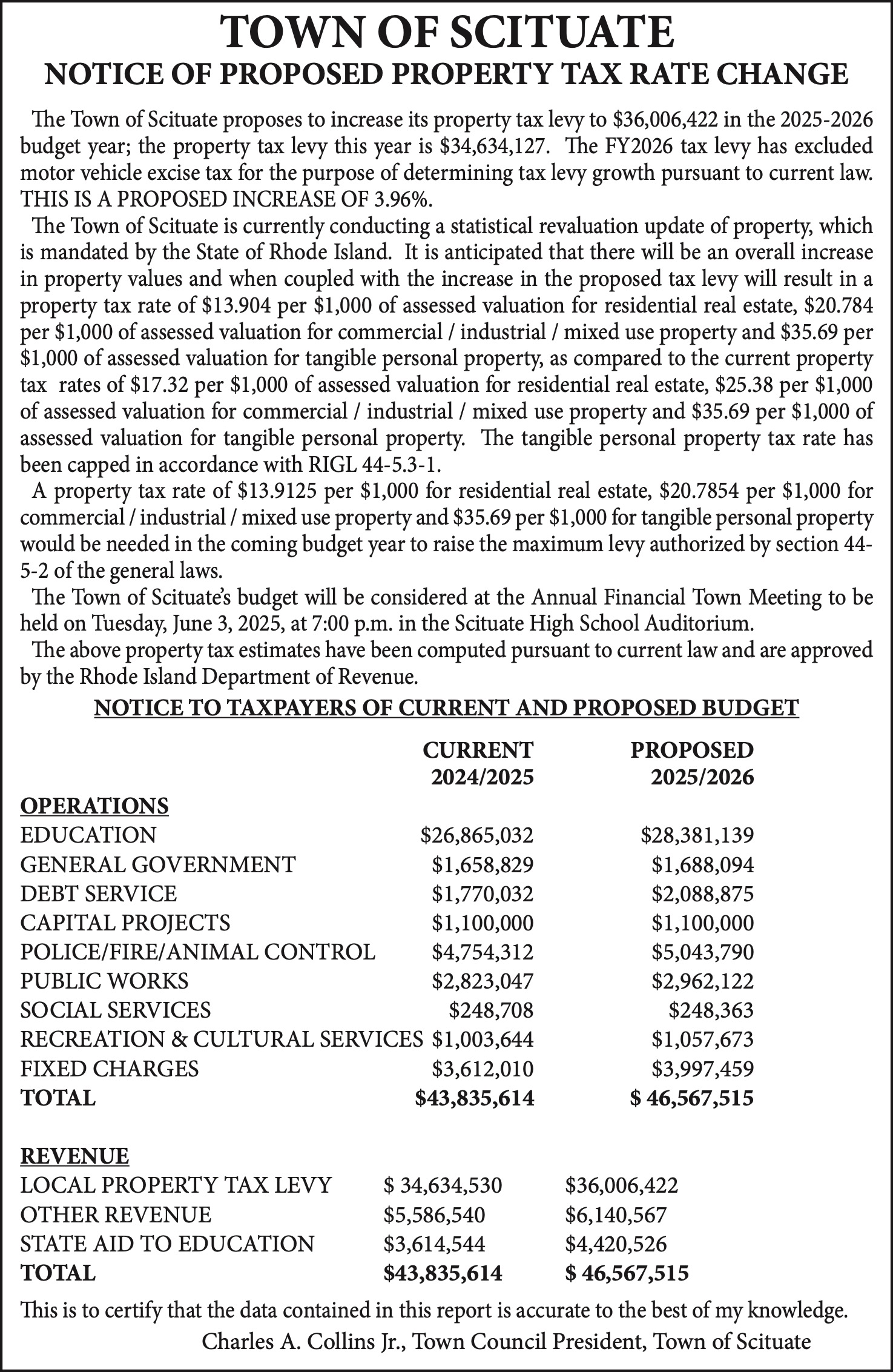

The Town of Scituate proposes to increase its property tax levy to $36,006,422 in the 2025-2026 budget year; the property tax levy this year is $34,634,127. The FY2026 tax levy has excluded motor vehicle excise tax for the purpose of determining tax levy growth pursuant to current law. THIS IS A PROPOSED INCREASE OF 3.96%.

The Town of Scituate is currently conducting a statistical revaluation update of property, which is mandated by the State of Rhode Island. It is anticipated that there will be an overall increase in property values and when coupled with the increase in the proposed tax levy will result in a property tax rate of $13.904 per $1,000 of assessed valuation for residential real estate, $20.784 per $1,000 of assessed valuation for commercial / industrial / mixed use property and $35.69 per $1,000 of assessed valuation for tangible personal property, as compared to the current property tax rates of $17.32 per $1,000 of assessed valuation for residential real estate, $25.38 per $1,000 of assessed valuation for commercial / industrial / mixed use property and $35.69 per $1,000 of assessed valuation for tangible personal property. The tangible personal property tax rate has been capped in accordance with RIGL 44-5.3-1.

A property tax rate of $13.9125 per $1,000 for residential real estate, $20.7854 per $1,000 for commercial / industrial / mixed use property and $35.69 per $1,000 for tangible personal property would be needed in the coming budget year to raise the maximum levy authorized by section 44- 5-2 of the general laws.

The Town of Scituates budget will be considered at the Annual Financial Town Meeting to be held on Tuesday, June 3, 2025, at 7:00 p.m. in the Scituate High School Auditorium.

The above property tax estimates have been computed pursuant to current law and are approved by the Rhode Island Department of Revenue.

NOTICE TO TAXPAYERS OF CURRENT AND PROPOSED BUDGET

OPERATIONS

CURRENT 2024/2025

PROPOSED 2025/2026

$28,381,139 $1,688,094 $2,088,875 $1,100,000 $5,043,790 $2,962,122

$248,363 $1,057,673 $3,997,459

$ 46,567,515

$36,006,422 $6,140,567 $4,420,526

$ 46,567,515

EDUCATION $26,865,032

GENERAL GOVERNMENT

DEBT SERVICE

CAPITAL PROJECTS POLICE/FIRE/ANIMAL CONTROL PUBLIC WORKS

SOCIAL SERVICES

RECREATION & CULTURAL SERVICES

FIXED CHARGES

TOTAL $43,835,614

REVENUE

LOCAL PROPERTY TAX LEVY OTHER REVENUE

STATE AID TO EDUCATION TOTAL

$ 34,634,530 $5,586,540 $3,614,544 $43,835,614

$1,658,829 $1,770,032 $1,100,000 $4,754,312 $2,823,047

$248,708 $1,003,644 $3,612,010

This is to certify that the data contained in this report is accurate to the best of my knowledge. Charles A. Collins Jr., Town Council President, Town of Scituate