Smithfield, Town of

Smithfield, Town of

64 Farnum Pike, Smithfield, RI 02917

Public Notices

Ad textSmithfield, Town of NOTICE OF PROPOSED PROPERTY TAX RATE CHANGE

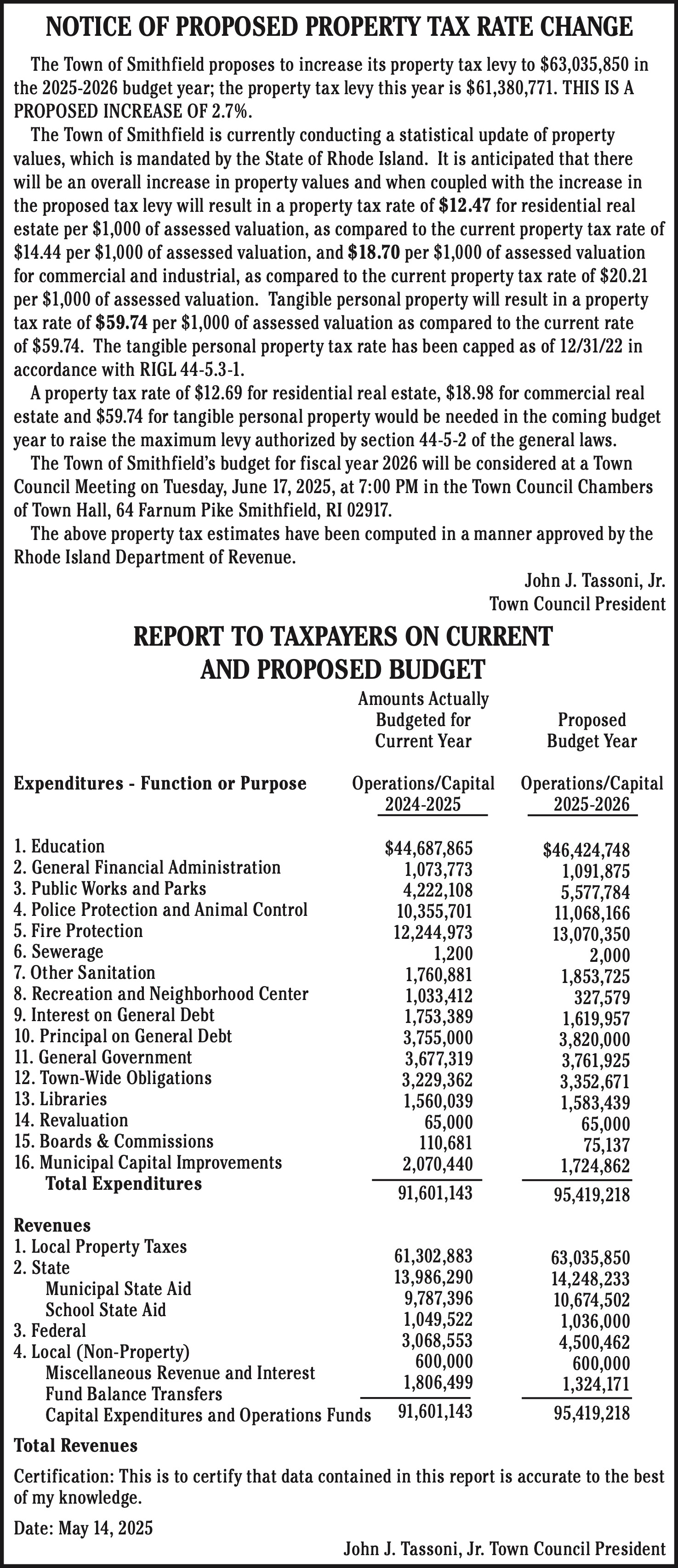

The Town of Smithfield proposes to increase its property tax levy to $63,035,850 in the 2025-2026 budget year; the property tax levy this year is $61,380,771. THIS IS A PROPOSED INCREASE OF 2.7%.

The Town of Smithfield is currently conducting a statistical update of property values, which is mandated by the State of Rhode Island. It is anticipated that there will be an overall increase in property values and when coupled with the increase in the proposed tax levy will result in a property tax rate of $12.47 for residential real estate per $1,000 of assessed valuation, as compared to the current property tax rate of $14.44 per $1,000 of assessed valuation, and $18.70 per $1,000 of assessed valuation for commercial and industrial, as compared to the current property tax rate of $20.21 per $1,000 of assessed valuation. Tangible personal property will result in a property tax rate of $59.74 per $1,000 of assessed valuation as compared to the current rate

of $59.74. The tangible personal property tax rate has been capped as of 12/31/22 in accordance with RIGL 44-5.3-1.

A property tax rate of $12.69 for residential real estate, $18.98 for commercial real estate and $59.74 for tangible personal property would be needed in the coming budget year to raise the maximum levy authorized by section 44-5-2 of the general laws.

The Town of Smithfields budget for fiscal year 2026 will be considered at a Town Council Meeting on Tuesday, June 17, 2025, at 7:00 PM in the Town Council Chambers of Town Hall, 64 Farnum Pike Smithfield, RI 02917.

The above property tax estimates have been computed in a manner approved by the Rhode Island Department of Revenue.

John J. Tassoni, Jr. Town Council President

REPORT TO TAXPAYERS ON CURRENT AND PROPOSED BUDGET

Expenditures - Function or Purpose

1. Education

2. General Financial Administration

3. Public Works and Parks

4. Police Protection and Animal Control 5. Fire Protection

6. Sewerage

7. Other Sanitation

8. Recreation and Neighborhood Center 9. Interest on General Debt

10. Principal on General Debt

11. General Government

12. Town-Wide Obligations

13. Libraries

14. Revaluation

15. Boards & Commissions

16. Municipal Capital Improvements

Total Expenditures

Revenues

1. Local Property Taxes 2. State

Municipal State Aid

School State Aid 3. Federal

Amounts Actually Budgeted for Current Year

Operations/Capital 2024-2025

$44,687,865 1,073,773 4,222,108 10,355,701 12,244,973 1,200 1,760,881 1,033,412 1,753,389 3,755,000 3,677,319 3,229,362 1,560,039 65,000 110,681 2,070,440

91,601,143

61,302,883 13,986,290 9,787,396 1,049,522 3,068,553 600,000 1,806,499

91,601,143

Proposed Budget Year

Operations/Capital 2025-2026

$46,424,748 1,091,875 5,577,784 11,068,166 13,070,350 2,000 1,853,725 327,579 1,619,957 3,820,000 3,761,925 3,352,671 1,583,439 65,000 75,137 1,724,862

95,419,218

63,035,850 14,248,233 10,674,502 1,036,000 4,500,462 600,000 1,324,171

95,419,218

4. Local (Non-Property)

Miscellaneous Revenue and Interest

Fund Balance Transfers

Capital Expenditures and Operations Funds

Total Revenues

Certification: This is to certify that data contained in this report is accurate to the best of my knowledge.

Date: May 14, 2025

John J. Tassoni, Jr. Town Council President